SENIOR HOUSING WAIT LISTS

SENIOR HOUSING WAIT LISTS – What You Need to Know.

Bruce B. Rosenblatt – Senior Housing Solutions

There is much to learn about waiting lists at Senior Living Communities. Understanding these basics will help you become better prepared. Here are some good tips for you:

THE NAME GAME

Senior Communities call their wait lists many different names such as Priority Club, Premier Club, Ambassador Club, etc. Some start-up communities or communities under expansion will create a separate list for early depositors. These folks will have “priority” when the actual residence is available to sell. Usually, during the priority phase, the initial deposit is fully refundable until the conversion takes place. It is highly rare that a community will complete the medical assessment at the time of becoming a priority member and will wait until someone actually reserves a specific apartment.

DEPOSIT REQUIREMENTS

Every community handles their wait list deposit differently. Some require a non-refundable deposit while others offer a fully refundable option. The amount of the deposit varies from community to community. Typically, a non-refundable model carries more weight since wait list members have something to lose if they back out. Even with a non-refundable deposit, there could be situations where it would be refunded, especially if someone passes away or has a change in their health. It is good to understand the terms of the agreement before you sign up.

FIRST RIGHT OF REFUSAL

Having the option to refuse an apartment when offered is very attractive to many people. Since timing is an unknown variable, some people want the option to either accept or refuse an apartment when offered. It is important to note that if you have been waiting for a certain floor plan and/or location and it becomes available, you might want to seriously consider accepting it, since you have no idea when the next one might become available. The other pitfall to avoid is waiting too long and not being medically approved.

INTERNAL vs. EXTERNAL

It is common that senior communities maintain an internal AND external wait list. An internal wait list comprises of people/residents who are already living at the community. These folks take priority over external wait list members, therefore if you are on an external wait list and are waiting for a highly desirable floor plan and/or location, there could be a good chance, a current resident is also waiting for the same residence.

Some communities offer a program for someone to become a resident without physically moving in. Sometimes these are called “ghosts.” A ghost member pays a reduced entrance fee and monthly fee, is medically approved, and has priority over external wait list members. A ghost member usually has certain resident privileges at the community including access to the on-site health care center.

THE THREE STRIKE RULE

Some communities institute a “three strike rule” on their wait list, meaning if you turn them down three times, you are dropped to the bottom of the list. It is good to know ‘the rules of the game’ before you place your wait list deposit.

MEDICAL APPROVAL

Most communities will not guarantee you medical approval when you join their wait list. This is because the wait list does commit you to a specific time frame, especially if you have the first right of refusal. Some might do a preliminary approval, so you have an idea of where you stand, and will update your medical history if your wait time goes beyond a certain period of time. It is imperative you understand this feature of the wait list, since many people put ‘all their eggs in one basket’ to move to a specific community to find out later, they have been denied.

KNOW THY NUMBERS

Knowing how many people are on are on the list is a good first step. Knowing how these numbers break down by unit type and the annual turnover percentage rate will help you better gauge your timing, however if you are waiting for a two bedroom and many couples live in two bedrooms at this community, you could be waiting for a long period of time, because you are basically waiting for two people to move out. If there is an internal wait list, it is important to know these numbers as well.

IT’S A NUMBERS GAME

Try to identify multiple floorplans and locations you might desire. This will help provide more opportunities for you. The narrower you are in your selection, the lower the percentage of being offered what you want. Some of our clients have their names at a couple of different senior communities in order to expand their choices. It is advisable to keep this confidential.

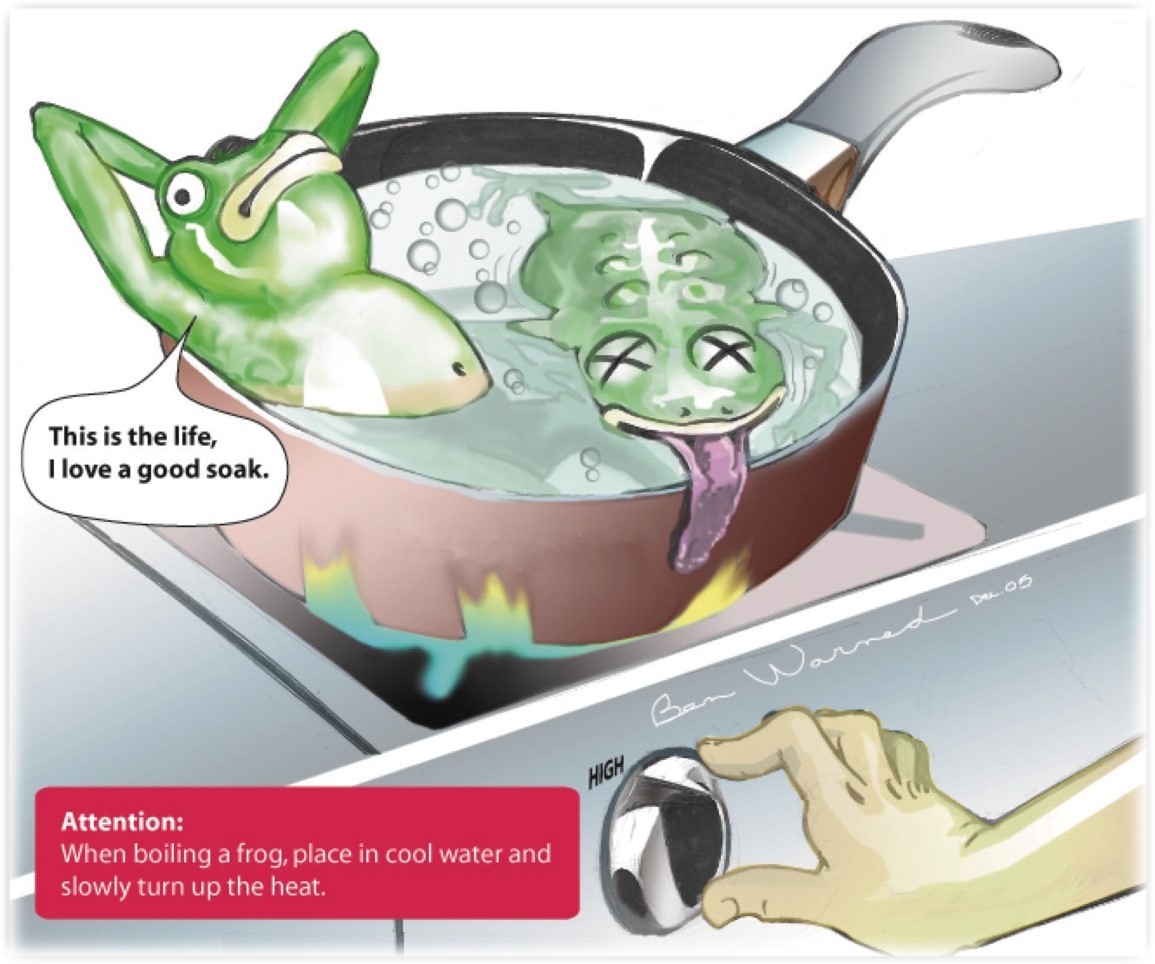

PUT YOUR TOE IN THE WATER

If you are on a wait list, you should stay in frequent contact with your chosen community so they are aware of your status, and you can be updated on future availabilities. If possible, you should try to participate in some community programs and events while you are waiting. This will help you become acclimated to the community lifestyle, staff, and meet other residents well before the moving truck arrives.

If we can be of any assistance understanding the wait list program at your desired community, please reach out to us at www.seniorhousingsolutions.net or call 239-595-0207.